"Simplicity is the master key to financial success." -- John C. BogleI know my allocation is a little all over the map, but I would love to hear thoughts from those with more experience and expertise than me!

X% Total US Stock (e.g., VTI)

Y% Total Int'l Stock (e.g., VXUS)

Z% Total US Bond (e.g., BND)

X+Y+Z = 100%

Those are your three components to a simple, yet fully diversified 3-Fund Portfolio. Keep it simple and you will succeed. Try to beat the market average with individual picks and there's an 80% chance you'll lose like all the professional fund managers that try and fail to beat the market every year (only a handful out of thousands succeed at that goal: Buffet & Koltrones are two current winners).

80% of Active Managers Fail to Beat the Market

The proportions among X, Y, and Z are defined by your asset allocation (AA) among stocks & bonds, and how much int'l stock exposure you want to diversify against single-nation financial risk (e.g., US versus ex-US). To choose an AA, consider the following...

Control Your Risk

Read the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was recommended by the quiz based on your knowledge of your personal risk tolerance having read the Wiki article.

Alternatively (or in addition to), ask "How much of a drop in portfolio value as a % of total value can I handle?" cut that % in half to get standard deviation, then lookup that std. dev. on the X-Axis of the chart below, and finally scan up to see what AA that corresponds to. As an example, if you can only stomach a -24% drop in portfolio value, that's a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is an average and you'll get what you get with your unique sequence of returns (there's a lot of variance in outcomes due to the associated volatility of stocks so it probably will NOT be the average, but something more or less).

On picking a percentage of stocks in international...

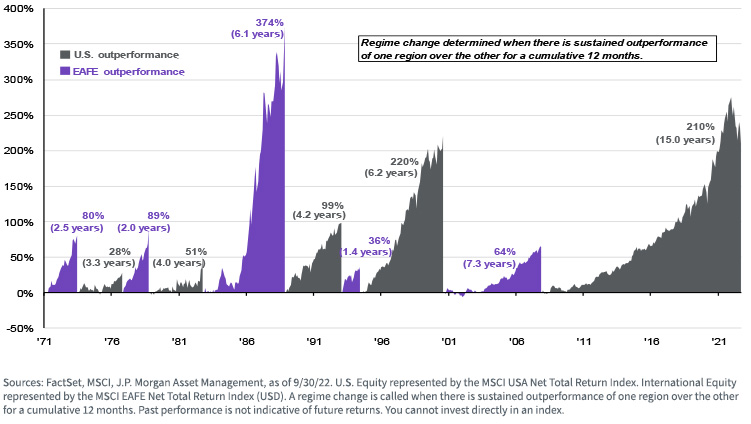

There's essentially two camps among Bogleheads: a) Those that are on board with the global market cap weighting, which is about 60% US stock and 40% ex-US stock; and b) those that are in the US will outperform forever, which is about 80% US stock and 20% ex-US stock (some even omit Int'l altogether). I'm in camp a) based on the the chart below from WisdomTree, the white paper from Vanguard, and the more recent article from Vanguard.

Vanguard White Paper: International Equity - Considerations and Recommendations

Vanguard Web Article: Making the case for international equity allocations

Statistics: Posted by bonesly — Wed Jul 31, 2024 6:17 pm