basically these funds are using options to hedge the downside risk. So they are supposed to not perform as bad as the market when the market falls. However, it appears to me there's a cap on performance which I believe means they don't get the return of the market:

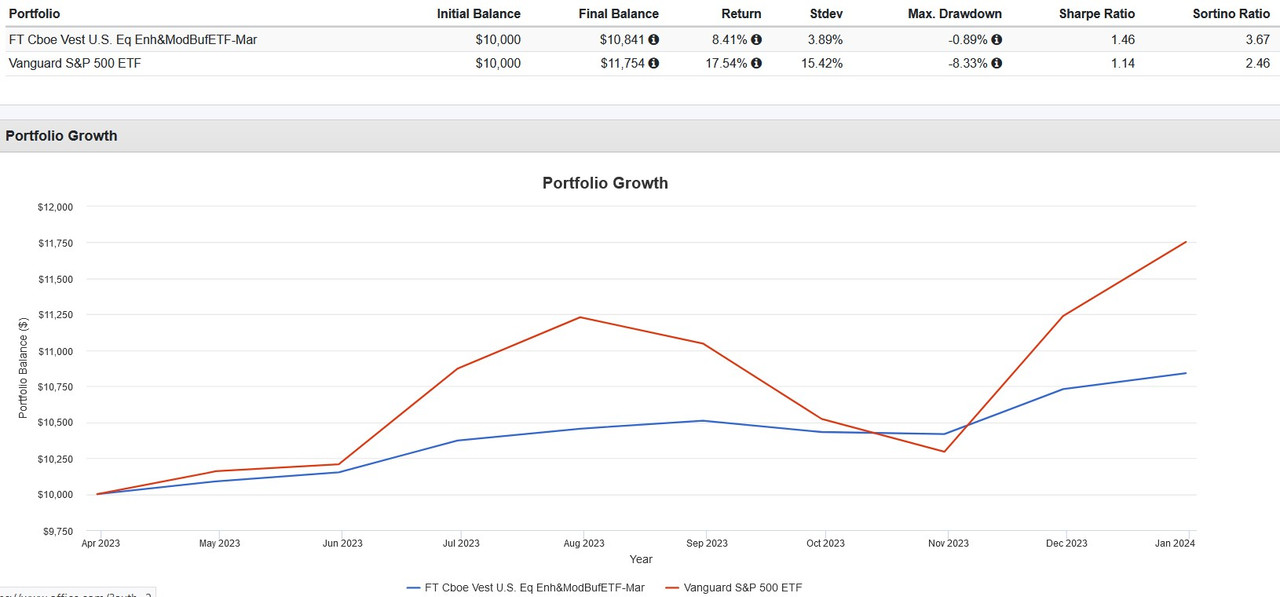

If you take a look at last year (can't look at the whole year because this fund only started in Apr) the FT Vest US equity shows the story:

![Image]()

source: https://www.portfoliovisualizer.com/bac ... OeRL4w11yl

see how the lows of FT wasn't as dramatic as for the S&P500? That's the hedging with options part. But note what was given up in return for that safety (smoother ride). Half the return of S&P500 was lost in this fund. The good news is the FT did have higher risk adjusted returns over S&P500. That's what the options did was provide return with less risk.

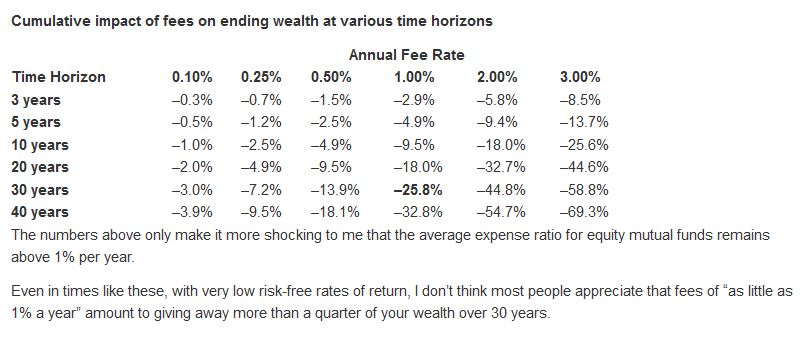

But these funds you listed charge 0.85% to 1.10% per year. That's giving up a good portion of return to fees. Like Bogle used to say, "You put up 100% of the money and take 100% of the risk but only get 60% of the return".

![Image]()

source: https://web.archive.org/web/20161110064 ... f-returns/

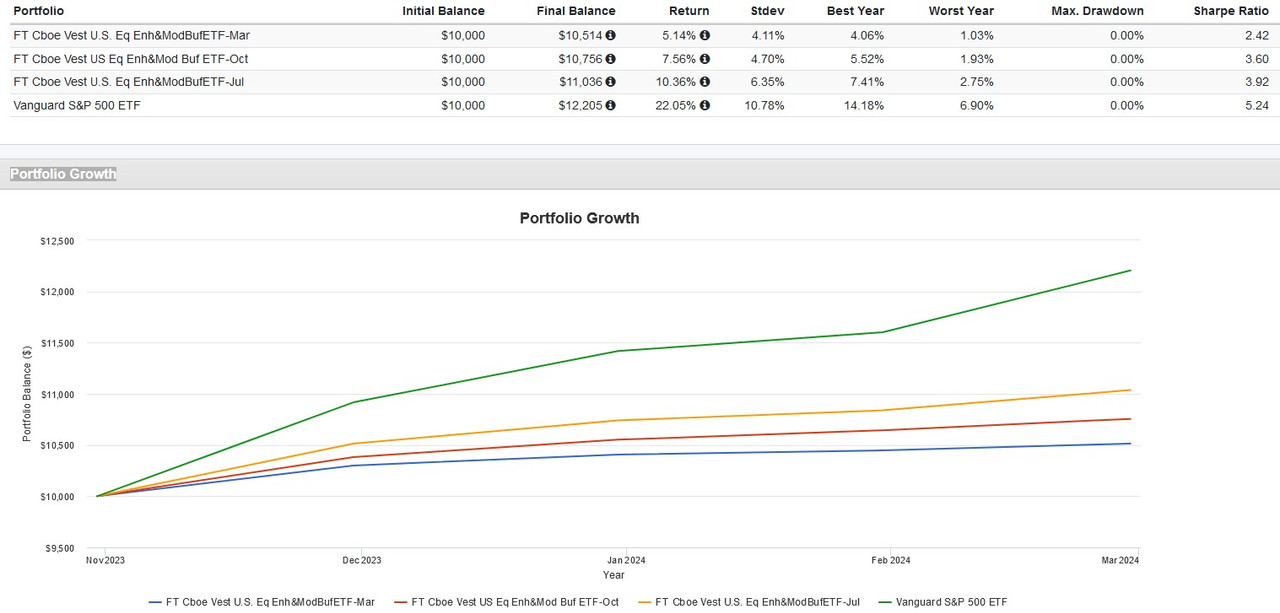

and yeah, i couldn't get data on one fund because it just started in Feb! But if we look at some of the others:

![Image]()

source: https://www.portfoliovisualizer.com/bac ... yl8qR5jsKo

we see they had lower risk adjusted returns than just the S&P500. The standard deviation (measure of risk/volatility) is less than S&P500 because of the hedging/options of these strategies, but they're likely to underperform long term because of the fees and the cap on performance.

So I guess the question is did the friend who invested $1 million understand what he was buying for $1 million?

So people get excited about "twice any positive price return" without looking at the "up to a predetermined upside cap" part.The investment objective of the FT Vest U.S. Equity Enhance & Moderate Buffer ETF - March (the "Fund") is to seek to provide investors with returns (before fees and expenses) of approximately twice any positive price return of the SPDR® S&P 500® ETF Trust (the "Underlying ETF"), up to a predetermined upside cap of 13.01% while providing a buffer (before fees and expenses) against the first 15% of Underlying ETF losses, over the period from March 20, 2023 through March 15, 2024.

If you take a look at last year (can't look at the whole year because this fund only started in Apr) the FT Vest US equity shows the story:

source: https://www.portfoliovisualizer.com/bac ... OeRL4w11yl

see how the lows of FT wasn't as dramatic as for the S&P500? That's the hedging with options part. But note what was given up in return for that safety (smoother ride). Half the return of S&P500 was lost in this fund. The good news is the FT did have higher risk adjusted returns over S&P500. That's what the options did was provide return with less risk.

But these funds you listed charge 0.85% to 1.10% per year. That's giving up a good portion of return to fees. Like Bogle used to say, "You put up 100% of the money and take 100% of the risk but only get 60% of the return".

source: https://web.archive.org/web/20161110064 ... f-returns/

and yeah, i couldn't get data on one fund because it just started in Feb! But if we look at some of the others:

source: https://www.portfoliovisualizer.com/bac ... yl8qR5jsKo

we see they had lower risk adjusted returns than just the S&P500. The standard deviation (measure of risk/volatility) is less than S&P500 because of the hedging/options of these strategies, but they're likely to underperform long term because of the fees and the cap on performance.

So I guess the question is did the friend who invested $1 million understand what he was buying for $1 million?

Statistics: Posted by arcticpineapplecorp. — Wed Mar 06, 2024 9:16 pm