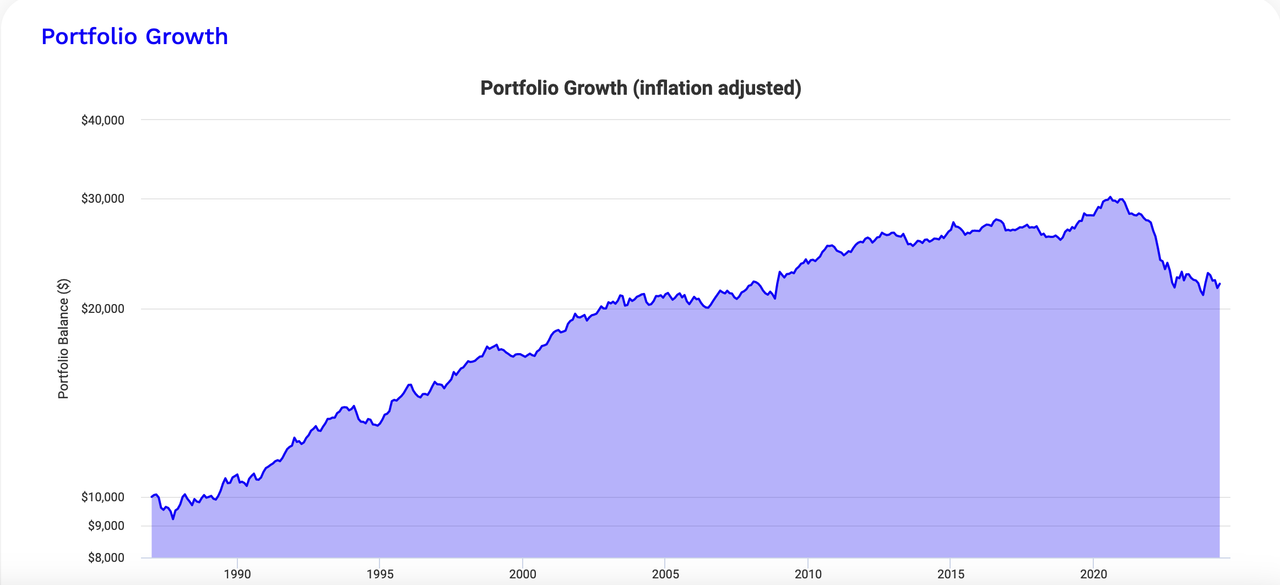

The entire bond market has done poorly in the recent decade or so, cause mostly by the interest rate hikes. If you take a look, bonds started to short of level out after 2010, then there was the bond bear market of 2022, the worse in recent history.

![Image]()

Bonds basically did poorly during this time period. Total Bond market return -0.52% real, Treasury returned -0.63% real, and corporate returned 1.13% real. Corporate bond did better but also fare worse in the 2022 bond market crash.

You might think. Bond is a terrible asset, let's just put everything into stock. There is a parallel to this. From 2000-2010, the stock market return -1% real for the entire decade. You would conclude that stocks was a terrible asset and put everything into bonds. The reason you have a mixture of different asset classes in a portfolio is because you don't know when an asset will go into favor and out. There is no good way to time the market.

Another factor to consider is your contribution's effect. From 2010-2024, your return on total stock market is -0.52% real. Let's say you had a $500K portfolio and contributed $10 a year during that time period, your return jumps to 1.06% real, and higher if you contributed more. The reason for this is when the bonds goes down, you buy more shares. This is how even though stocks were terrible in the 2000-2010, but if you had contributed regularly in stock for that decade, you would have had a decent return and even more so in the next decade.

The lesson here is not to based your investment based on return in the recent time period. Select an appropriate allocation of stocks and bond and stick to it and rebalance.

Bonds basically did poorly during this time period. Total Bond market return -0.52% real, Treasury returned -0.63% real, and corporate returned 1.13% real. Corporate bond did better but also fare worse in the 2022 bond market crash.

You might think. Bond is a terrible asset, let's just put everything into stock. There is a parallel to this. From 2000-2010, the stock market return -1% real for the entire decade. You would conclude that stocks was a terrible asset and put everything into bonds. The reason you have a mixture of different asset classes in a portfolio is because you don't know when an asset will go into favor and out. There is no good way to time the market.

Another factor to consider is your contribution's effect. From 2010-2024, your return on total stock market is -0.52% real. Let's say you had a $500K portfolio and contributed $10 a year during that time period, your return jumps to 1.06% real, and higher if you contributed more. The reason for this is when the bonds goes down, you buy more shares. This is how even though stocks were terrible in the 2000-2010, but if you had contributed regularly in stock for that decade, you would have had a decent return and even more so in the next decade.

The lesson here is not to based your investment based on return in the recent time period. Select an appropriate allocation of stocks and bond and stick to it and rebalance.

Statistics: Posted by gavinsiu — Mon Jun 17, 2024 7:33 am